What is the claims process in Ireland?

Author: Gary Matthews, Principal Solicitor (Law Society No: S8178) • Reviewed: 21 August 2025 • Sources last checked: 21 August 2025

If you're injured in a car accident in Ireland, the claims process usually starts with the Injuries Resolution Board (IRB). File a valid application within the time limit, gather medical and expense evidence, and await assessment. If either side rejects the assessment, you may get court authorisation.

Did you know? Fast facts

- IRB mediation for motor liability: Available since 12 December 2024, expanding on earlier employer and public schemes.[4]

- €700m+ awarded: Over 76,000 motor claims (2019–2024) resulted in more than €700 million in compensation.[8]

- 2024 highlights: 12,000+ new claims (↑4% vs 2023; ↓30% vs 2019); total awards €105.8m (↑5% vs 2023; ↓41% vs 2019).[8]

- Median award up 17%: 2024 median €12,541; average €17,333 (↑9%).[9]

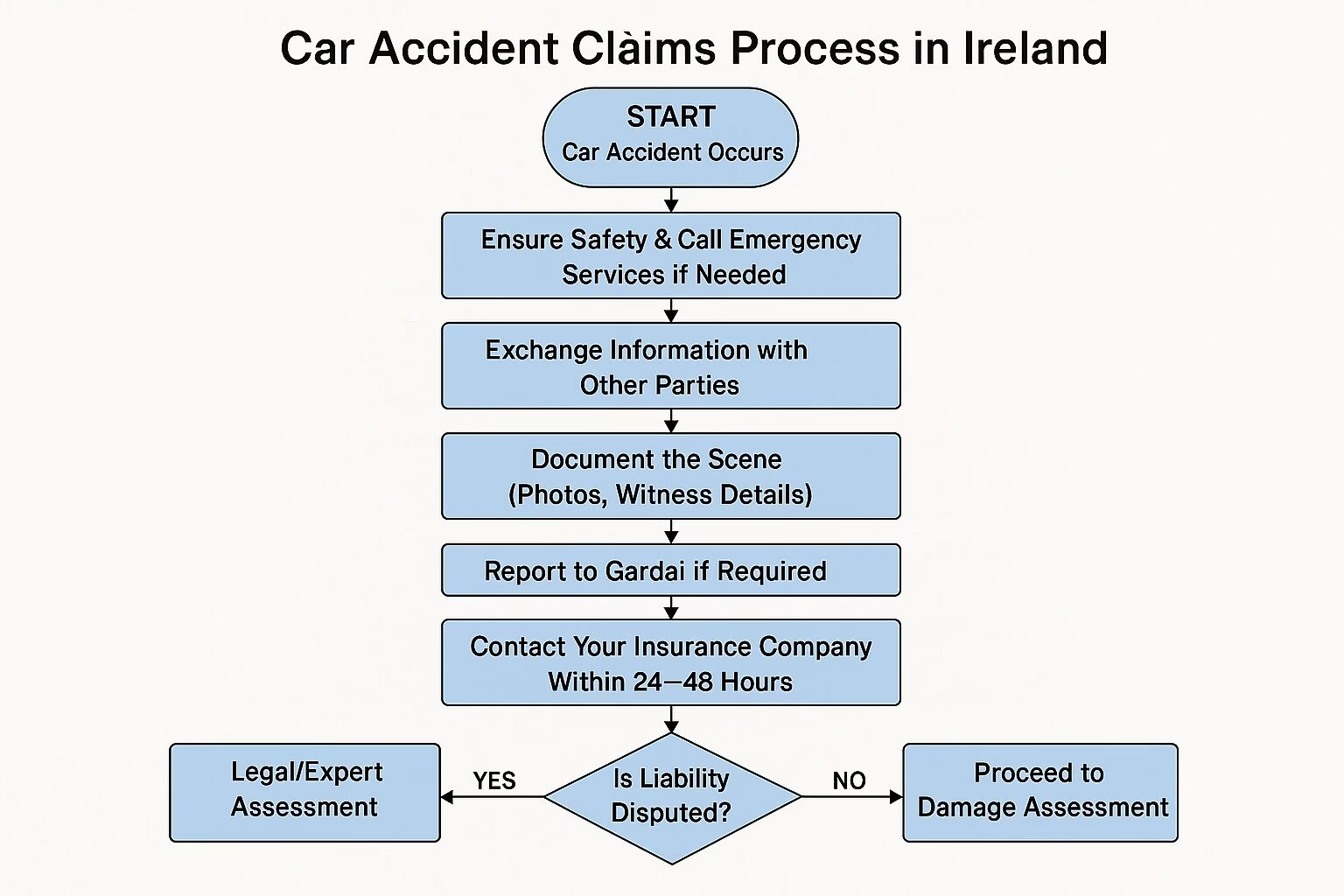

Pre-claim preparation: what to do first

- Report the collision to Gardaí. Don't admit fault.

- Attend a GP or hospital within 24–48 hours and request a full medical report.

- Take photos, collect witness contacts, and keep all receipts.

- Keep your Garda incident reference for the IRB application.

Car accident claim timeline

What are the steps in making a car accident claim?

- Apply to IRB with medical report and fee.[2]

- Respondent notified — up to 90 days to consent.

- Mediation or assessment — IRB evaluates the claim.[4]

- Assessment results — you have 28 days to accept; respondent 21.[2]

- Outcome — accept (Order to Pay) or seek court authorisation.[6]

What evidence do I need for a claim?

- Medical report (diagnosis, causation, prognosis)

- Scene and injury photos; vehicle damage photos

- Witness names and contact details

- Receipts for treatment and travel

- Garda incident reference and any statements[1]

See our car accident compensation guide for worked examples.

Back to topIRB statistical snapshot

Insurance premium context

Despite IRB efficiencies reducing injury-related legal costs, premiums continue to rise.

- H1 2024: Injury claims costs up 13%, but still 16% lower than pre-COVID averages.[10]

- IRB vs litigation: Litigation remains longer and costlier than IRB resolution.

Source: Central Bank of Ireland, motor claims trends (H1 2024).

Back to topWhat if the other driver is uninsured or leaves the scene?

See our detailed guide: Uninsured Driver Claims.

Back to topWhat is contributory negligence?

Compensation reduces where the injured person shares fault (for example, not wearing a seatbelt). The reduction is fact-specific and guided by case law.

Compensation (brief)

| Injury type | Typical range (€) |

|---|---|

| Minor whiplash | €500 – €3,000 |

| Moderate fractured limb | €10,000 – €60,000 |

| Moderate psychological injury | €500 – €35,000 |

| Catastrophic injury (lifetime care) | Up to €550,000 |

Full brackets and examples live on our compensation page.

Back to topTourist & non-resident claims – what changes?

Visitors injured in Ireland can apply to the IRB if the accident occurred here. Provide a correspondence address and translations where needed. Keep travel records and explain how the injury disrupted work or your trip.[2]

Back to topInteractive claim timeline

Checklist – after a car accident

Open checklist

Download this checklist (.txt)

Back to topWhen should I not make a claim?

Claims may be unsuitable where the limitation period has expired, evidence of injury or causation is weak, or likely compensation is small compared with time and cost. If unsure, ask for early guidance.

Back to topReal case snapshots (anonymised)

- Dublin, 15 Aug 2024: Rear-end collision, soft-tissue injuries. Early GP report and physio receipts supported a guideline-range award.

- Cork, 12 Mar 2025: Cyclist struck at junction, fractured wrist. CCTV and witness evidence led to acceptance of the IRB assessment.

- Galway, 30 Jan 2025: Hit-and-run at night. Garda report and neighbour dashcam enabled an MIBI claim to progress.

Find us

Gary Matthews Solicitors, 3rd Floor, Ormond Building, 31–36 Ormond Quay Upper, Dublin, D07, Ireland.

Costs and charging arrangements

Before work begins, we will explain our legal costs and charging arrangements, including likely outlays such as medical reports. Costs vary with case complexity, evidence needs, and whether litigation is required.

Request a consultation to discuss your situation.

Frequently asked questions

How long do I have to make a claim?

Usually two years minus one day from the accident or your date of knowledge. A valid IRB application can pause the limit.[1][2]

Can I go straight to court?

No. You must first apply to the IRB. If not resolved, you may get authorisation to issue proceedings.[2][6]

How long does an IRB claim take?

Many complete within 6–12 months, depending on consent and medical complexity.[5]

Do I need a Garda report?

Not always, but reporting helps. Keep your incident reference and any statements.[1]

What if the other driver is uninsured?

You may claim via the MIBI for uninsured or untraced drivers. Report to Gardaí early.[7]

Can I claim as a passenger?

Yes, where someone else's negligence caused your injury.

What is "date of knowledge"?

When you first knew you were injured and that the accident caused it. The limitation can run from this date.[1]

Are psychological injuries covered?

Yes, with diagnosis and proper treatment records.

Will I need to attend court?

Not if both parties accept the assessment. If either rejects it, litigation may follow after authorisation.[6]

Can non-residents make a claim?

Yes, if the accident happened in Ireland. Provide a correspondence address and translations if needed.[2]

What documents go in an IRB application?

Form, medical report, fee, incident details, and supporting evidence such as photos and receipts.[2]

Will my insurance be affected?

If you're at fault, your premium may rise. If you're not at fault, it typically shouldn't, but check with your insurer.

Glossary

- IRB

- Injuries Resolution Board (formerly PIAB) — statutory body assessing personal injury claims.

- PIAB

- Personal Injuries Assessment Board (former name of IRB).

- Date of knowledge

- When you first knew you were injured and that it was caused by the accident.

- MIBI

- Motor Insurers' Bureau of Ireland — handles uninsured and untraced driver claims.

- Order to Pay

- Binding order after both parties accept an IRB assessment.

- Contributory negligence

- Where the injured person shares fault, reducing the award.

References

- Citizens Information – IRB overview & time limits. Accessed 21 Aug 2025. citizensinformation.ie

- Injuries Resolution Board – Making a claim (How to). Accessed 21 Aug 2025. injuries.ie

- Judicial Council – Personal Injuries Guidelines (main page). Accessed 21 Aug 2025. judicialcouncil.ie

- gov.ie – IRB mediation for motor liability (commenced 12 Dec 2024). Accessed 21 Aug 2025. gov.ie

- IRB Help & FAQs – processing and timelines. Accessed 21 Aug 2025. injuries.ie

- Courts Service of Ireland – Civil process overview & authorisation. Accessed 21 Aug 2025. courts.ie

- Motor Insurers' Bureau of Ireland – Uninsured and untraced driver claims. Accessed 21 Aug 2025. mibi.ie

- Injuries Resolution Board – Annual/Statistics 2024. Accessed 21 Aug 2025. injuries.ie

- Law Society Gazette – Compensation statistics 2024. Accessed 21 Aug 2025. lawsociety.ie

- Central Bank of Ireland – Motor claims trends H1 2024. Accessed 21 Aug 2025. centralbank.ie

Gary Matthews Solicitors

Medical negligence solicitors, Dublin

We help people every day of the week (weekends and bank holidays included) that have either been injured or harmed as a result of an accident or have suffered from negligence or malpractice.

Contact us at our Dublin office to get started with your claim today